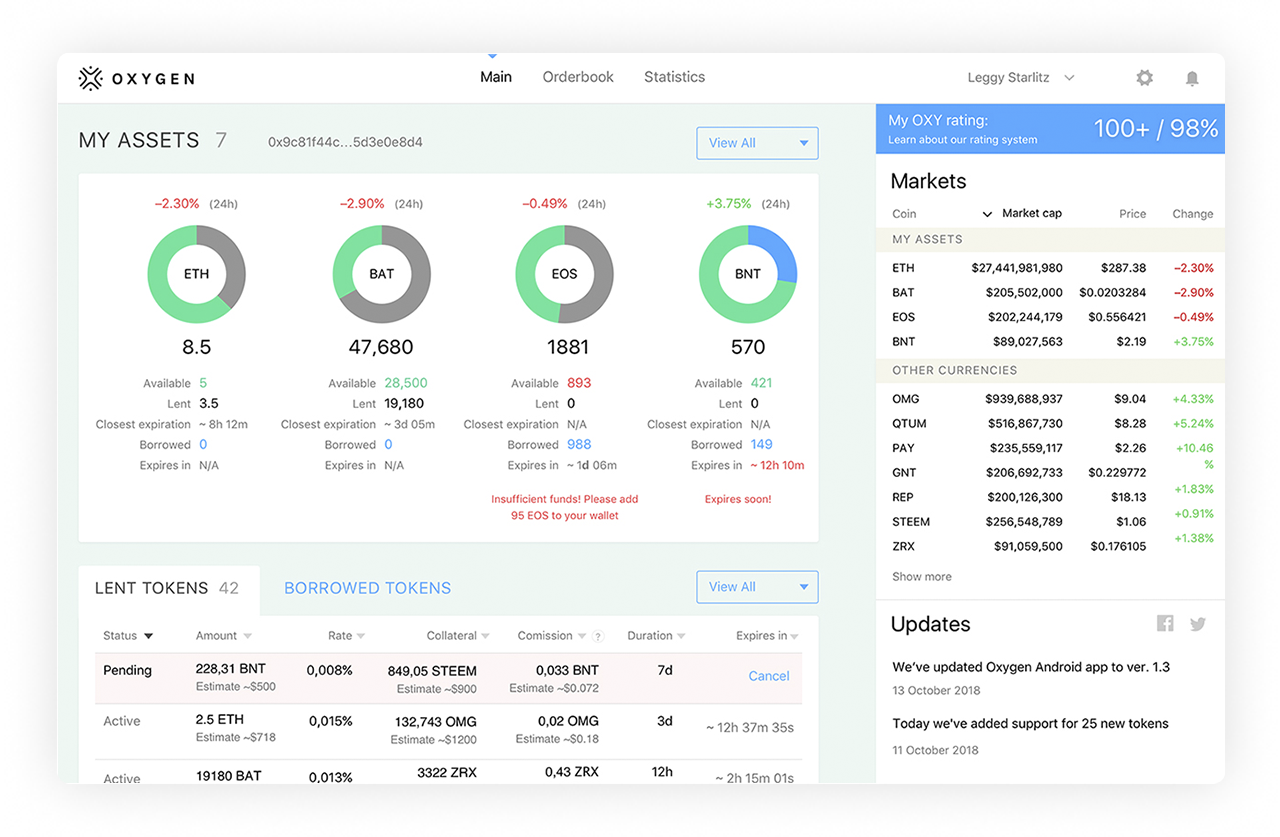

Connect to all market

players in a secure way.

Keep assets safe.

Reduce risk and cost.

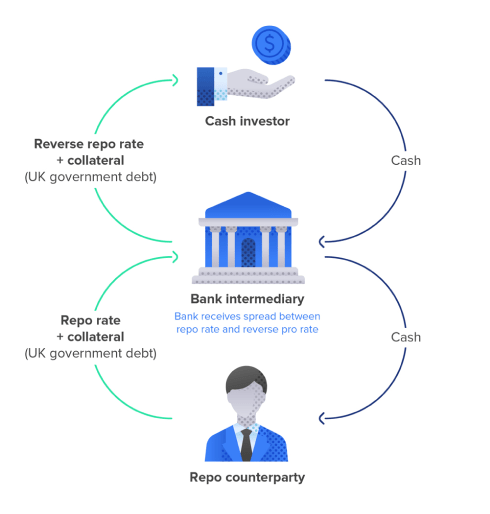

A repo is an agreement to sell assets and repurchase them on a specified future date ("maturity") at a pre-agreed price.

Economically repo is as a loan secured against collateral.

Repo markets are the oil that lubricates financial markets; more than $12 trillion repos outstanding in the US and Europe.

Connect to all market

players in a secure way.

Keep assets safe.

Reduce risk and cost.

Enjoy standarts of GMRA — market protocol of real world repo. It has stood the test of time, including the Lehman bankruptsy.

Use of source Ethereum

crypto assets to start with.

Bitcoin and other to follow,

as cross-chain technology develops.

Trust and verify. Regulations ensure fair dealing and transparensy.

Oxygen is to be regulated under the DLT regime in Gibraltar.

We plan to register as an Alternative Trading System (ATS) in the US.

Benefit from access to B2C

and B2B liquidity.

1,600,000 users of Changelly

to join first.

The launch of Oxygen is a fresh development in a market that has seen astronomical price gains but...

A former Goldman Sachs banker plans to launch a digital currency platform...

Holders of a cryptocurrency—institutions or private individuals—will earn money from lending it out via the...

Alex Grebnev, a former Wall Street investment banker, is launching a platform, called Oxygen, that will allow...