Oxygen offers the opportunity for traders to borrow cryptocurrency to cover short positions, but in order for traders to use the world’s first decentralized CryptoRepo platform effectively, it is still necessary to understand when and how the market will fluctuate. Especially for those who are new to crypto trading, it is vitally important to understand the mechanics behind price movements in the market. There are innumerable factors to consider, and it is impossible to take them all into account, but by continually educating yourself about the inner workings of the cryptocurrency market, you can improve your ability to capitalize on this knowledge.

Historic year for crypto

The past year was of historic importance for the future of cryptocurrencies. It marked their maturation into an entirely new asset class. This was underscored by a meteoric rise in the price of cryptocurrencies, with Bitcoin and Ethereum having led the charge for most of 2017. Before we explore the main factors that influence their pricing, we have to understand the inherently complex and multi-faceted role they are designed to play.

Loyal followers: driving force

The number of loyal followers who represent the core cryptocurrency investor base has grown exponentially over the past few years, and this should be primarily attributed to their promising outlook as the future of mediums of exchange. Essentially, true believers see in cryptocurrencies currency constructs that offer a uniquely robust and credible store of value, which is — for the most part — outside the purview of governments. This is a remarkable advantage in the midst of an era characterized by unprecedented central bank intervention that has deeply distorted the normal functioning of markets and created concerns about the long-term integrity and purchasing power of traditional currencies. In that sense, cryptocurrencies provide a much-needed alternative that offers an enhanced level of security from external intervention, while potentially shielding from recurrent financial instability. The greater the perception that a digital currency effectively grants such a security advantage, the stronger the underlying demand will be, which, in turn, increases its price, both in absolute terms and on a relative basis relative to its peers within the sphere of the cryptocurrency market.

Market consensus

Another key factor that shapes the outlook for a cryptocurrency and determines its price direction is the market consensus regarding its prospects for widespread adoption. Strengthening investor confidence regarding the likelihood that specific cryptocurrencies will be adopted by a rapidly expanding range of users tend to trigger sharp price upswings. In fact, they are often viewed as a precursor of increased institutional involvement in the cryptocurrency market.

Bitcoin futures and the great rally

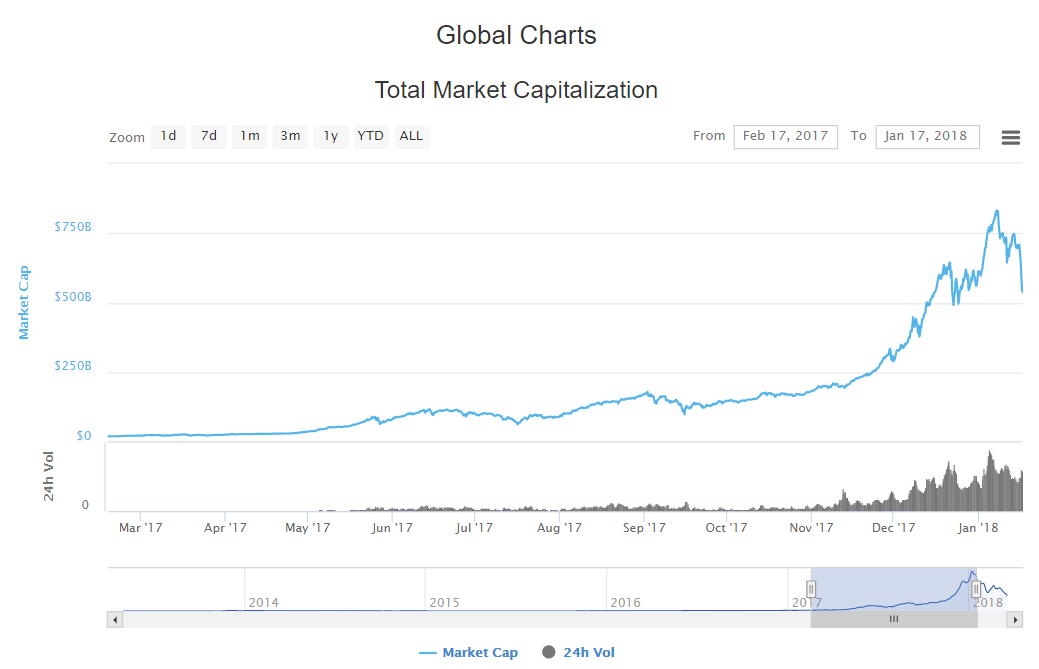

As an illustration, the hype surrounding the recent introduction of Bitcoin futures on the CME and CBOE initially triggered an impressive upward price movement that extended well beyond the Bitcoin market. This development was perceived by cryptocurrency investors and traders as the catalyst that would address the lingering concerns about the legitimacy of digital currencies. As a result, it generated ripple effects of growing optimism, which translated into a surprisingly strong and self-reinforcing rally across all major cryptocurrencies. Between the start of November and mid-December, Bitcoin rallied from approximately $6,000 to $20,000. More importantly, that phenomenal rally resulted in a durable rally which saw the total capitalization of the cryptocurrency market to climb from less than $200 billion in early November to more than $800 billion in the span of two months.

Government and regulation

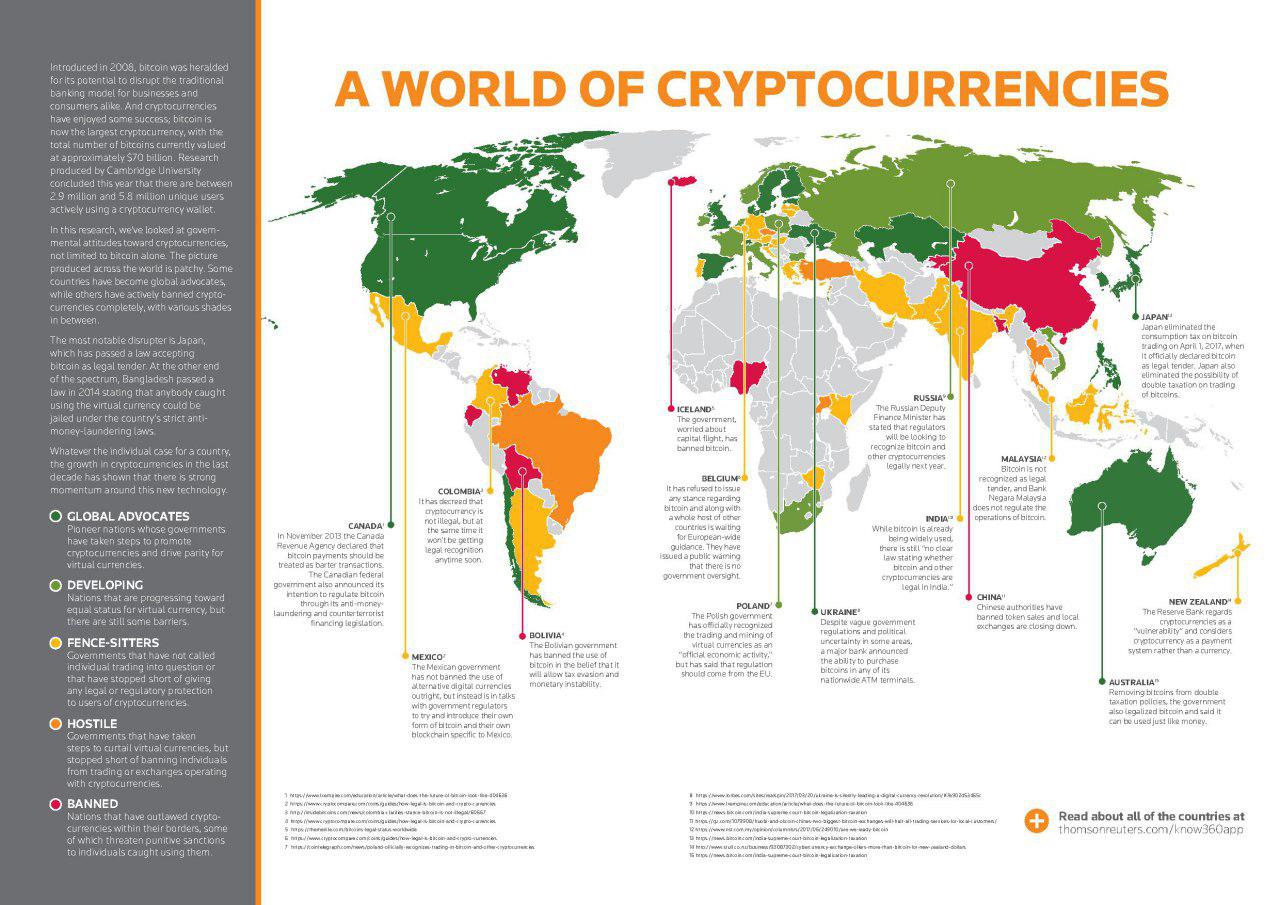

Notwithstanding the stellar gains of recent months, cryptocurrencies — even Bitcoin and Ethereum — are still in their infancy and the road toward broader acceptance is fraught with risks and challenges. Arguably the most significant unknown factor along this maturation process is the stance of governments around the world. We cannot yet be certain of the regulatory approach that will prevail, but we do know that it will have a decisive impact on cryptocurrency valuations. As such, all news associated –directly or indirectly– with the future of government regulation regarding digital currencies should be considered a major source of influence in terms of price gyrations and broader trend direction in the cryptocurrency market. Indeed, if we examine the main drivers of price action over the past few weeks, we have to identify the rumors relating to upcoming legislation as the most consequential force.

News coverage and crypto price swings

The latest example of how dramatic effect news coverage concerning the regulatory regime can have on cryptocurrency price oscillations emerged very recently. Namely, rumors that China, Russia and South Korea are considering the implementation of surprisingly restrictive regulations on cryptocurrency trading triggered a renewed bout of volatility. As a result, Bitcoin, Ethereum and Ripple suffered steep, double-digit price declines. Yet, it has to be understood that this is simply a symptom of the nascent stage of digital currencies, and it is likely to prove a transitory phenomenon, whose influence in the pricing of cryptocurrencies will likely wane as the legal landscape surrounding the cryptocurrency market solidifies.

Speed, accessibility and reliability

From a purely fundamental perspective, the unique combination of qualities that each individual cryptocurrency offers is a crucial driver of future price gains, especially in the long-term. On the basis of assessing each digital currency, is the blockchain, which essentially refers to a ledger technology designed to function as a means to safely transfer assets and data online. Hence, the three major aspects that add value to a cryptocurrency should be broken down to speed, accessibility and reliability. It goes without saying that transactions that can be executed through a more secure, more practical and more fast venue will be preferred. Consequently, long-term cryptocurrency investors would be wise to take these key parameters into consideration when assessing digital currencies and evaluating their potential over the long run. The remarkable transparency of the crypto market, which levels the playing field allowing users to compare digital currencies swiftly and easily, means that the cryptocurrencies which embody the optimal iterations of the blockchain technology will eventually outpace in popularity the competition.

Price volatility and risk

An often overlooked, yet quite significant characteristic of cryptocurrencies, especially in today’s markets, is their exceptional price volatility. The level of volatility is closely interrelated with the risk level of an investment. As a result, when market sentiment sours, diminishing risk-appetite among market participants, investments that have consistently demonstrated elevated price volatility tend to face increased pressures and often suffer precipitous price declines, as panic-selling gathers steam. We should, therefore, never disregard the volatility factor when analyzing or projecting the performance of digital currencies. Risk tolerance has a dynamic nature, and thereby cryptocurrency investors should always bear in mind the reflexive relationship between volatility and the long-term investment performance of any given asset.

Evolution of new asset class

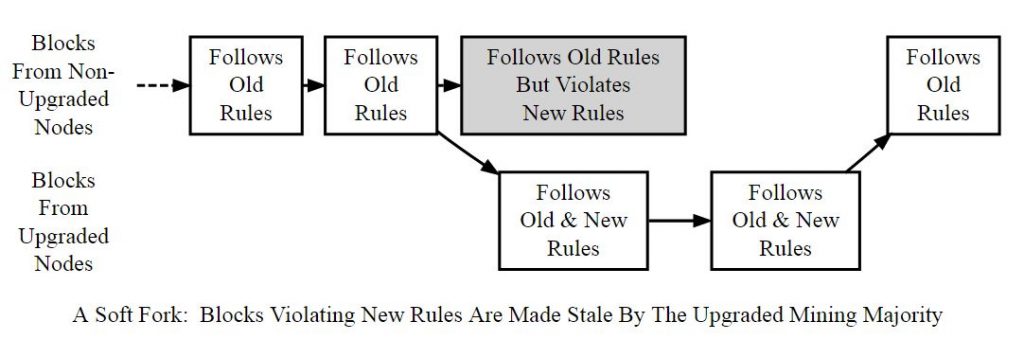

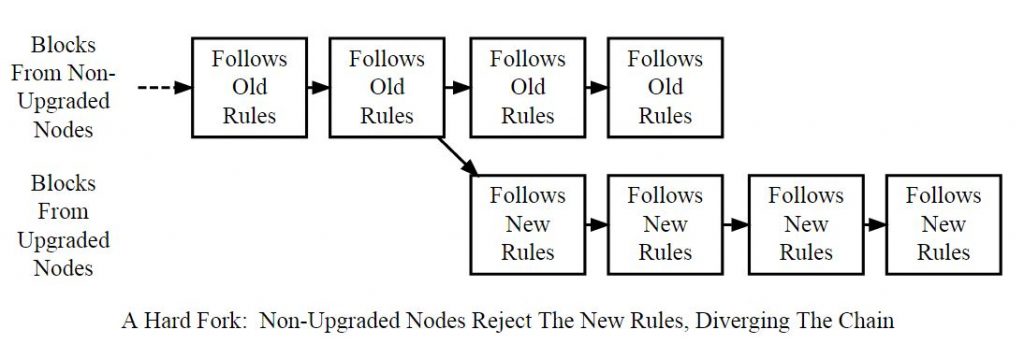

Admittedly, the fluidity of the cryptocurrency market in this very early stage in its life cycle indicates that several of today’s key drivers behind cryptocurrency price movements will evolve in ways that are impossible to accurately predict. One manifestation of the underlying fluidity is the “fork”, which essentially reflects the change of a digital currency’s software, in order to generate two separate versions of the blockchain. In turn, this process leads to the birth of two individual digital currencies which retain a shared history. This process corroborates how vital it is for cryptocurrencies to constantly evolve.

Investopedia: Hard Forks vs. Soft Forks

The net impact of this transformative process on cryptocurrency valuations is generally positive when assessed from a long-term perspective, because it is aimed at enhancing accessibility, introducing significant improvements and adding value. Internalizing this evolutionary nature of digital currencies, sheds light on the constant ongoing change within the core of this new asset class. This can help new traders as well as veteran cryptocurrency investors optimize their decision making and manage the underlying risk more effectively.